ONE HUNDRED YEARS OF PORTS IN WASHINGTON

As settlers migrated across the country, they often chose locations near water. Washington State was no different – with many deep harbors and navigable rivers, towns sprung up throughout the state, dependent on access to water for movement of goods and people.

In 1889, the new state constitution declared that these beds of navigable waters belonged to the people, and gave the Legislature power to designate which of those beds would become harbors. In 1911, after citizens lobbied for the right to control access to the waterfront, the Legislature passed the Port District Act, allowing the people to form a port district and elect commissioners to govern it.

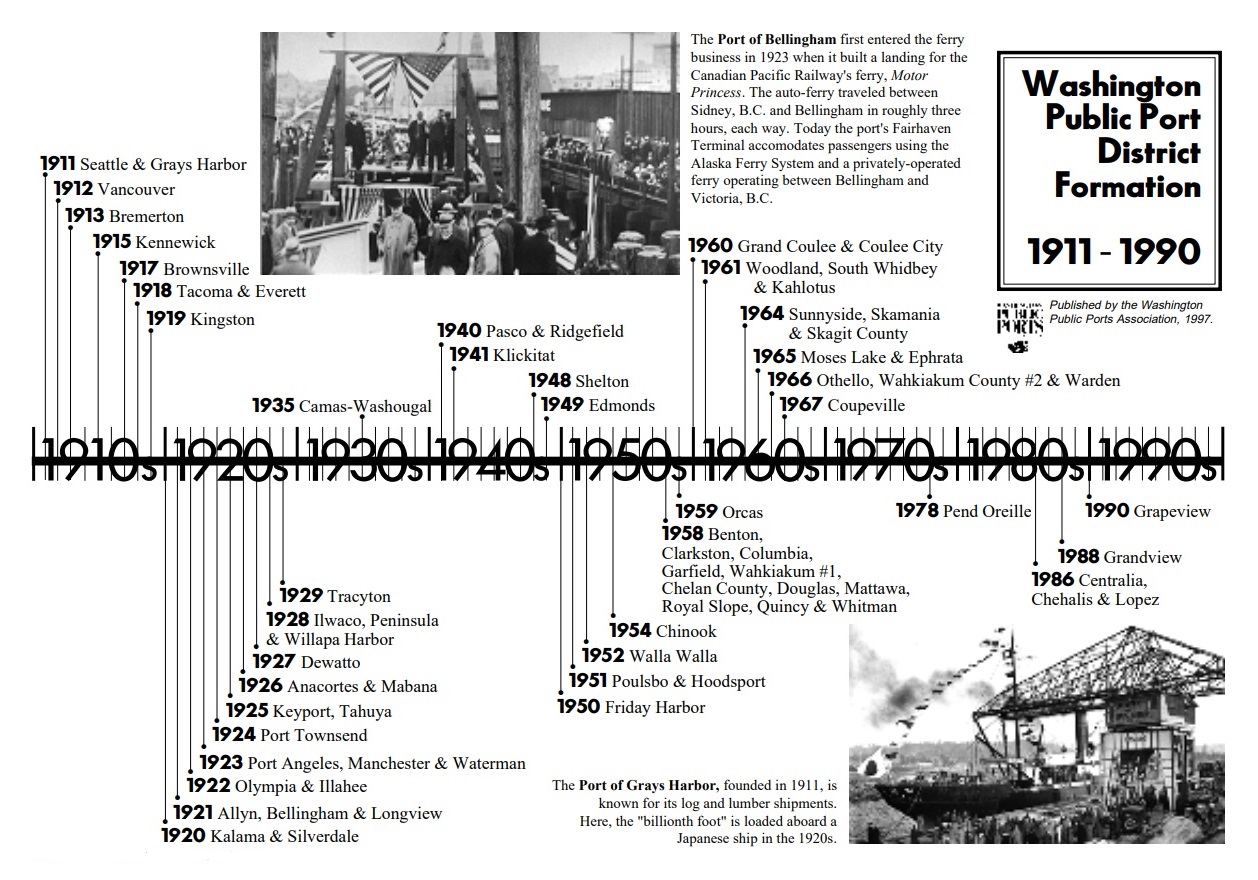

In September of 1911, the Port of Seattle was formed, becoming the first autonomous municipal corporation in the nation to engage in port terminal operation and commerce development. The Port of Grays Harbor was formed shortly thereafter. Since then, more than 80 port districts have formed in Washington, all contributing to the state’s healthy trade economy.

Currently, there are 75 public port districts in Washington. Large and small, east and west, Washington’s ports are active in many different areas of economic development, providing jobs and economic stimulation for their communities.

PORT JARGON

Here’s a list of terms frequently referenced in the port world, to become a bit more familiar.

How Ports are Governed

Port districts in Washington are unique: they are governed by an elected commission, independent of other local jurisdictions. Commissioners are elected to either four- or six-year terms; if there are five members of a commission, they hold office for four years. If there are three members, the term is six years. Commissioners may hold either district-specific or at-large positions, depending on port district policy.

Port commissions establish long-term strategies for a port district, and create policies to guide the development, growth, and operation of the port. They are also responsible for a port’s annual budgets, approving tax levy rates, and hiring the professional staff members responsible for a port’s daily functions.

Port Financing

Ports are a unique animal – a public entity with a profit motive, or public enterprises. A port district’s primary goal is economic development for its community, with the end result of job creation. And not just jobs, but jobs that pay a family wage and encourage growth throughout the port’s district. Port districts are able to finance the long-term investments needed for such growth with four different sources of revenue: taxes, service fees, bonds, and grants or gifts.

Taxes

The Port District Act which authorized citizens to form a port district also authorized a tax levy to finance the district. Initially, ports were authorized to collect $2 for every $1,000 of assessed value on taxable property. The funds provided the initial capital needed to construct and operate facilities and to establish the necessary reserve of funds. Since that time, the Legislature has reduced the rate at which a port district may levy taxes (its millage rate) to 45 cents per $1,000 of assessed value. In addition, special property tax levies are authorized for dredging, canal construction, land leveling or filling; these levies cannot exceed the 45 cents per $1,000 millage rate.

Most ports use the funds generated through the tax levy to pay for capital development – marine terminals, industrial parks, development of needed infrastructure, updated airport facilities. Investment in these facilities is necessary to attract and retain businesses to a region.

Ports pay sales taxes on their purchases, and also pay a business and occupation (B&O) tax on services they provide to their customers. Businesses who lease port property pay a leasehold tax, approximately equal to a property tax. Ports collect these taxes on behalf of the state, and the funds are distributed back to state and local governments.

Service Fees

When a port district builds a facility, it typically leases it to a business and collects fees for the building and land. Examples of those fees include marine terminal leases, airport landing fees, and moorage fees at marinas.

Bonds

Ports may issue a variety of municipal bonds – these bonds are used almost exclusively for capital construction projects. The bonds are repaid with revenue from property taxes. Ports may also issue revenue bonds, which are guaranteed by the revenues generated by a specific project. Bonds provide the funds for a port district to make a major, long-term investment in infrastructure – an investment which typically benefits a community for decades to come.

In very specific situations, ports may also establish a special assessment to issue industrial development revenue bonds. These bonds do not generate revenue for the port; rather, they provide a way to finance development or expansion of industry within a port district. The bonds are issued for a specific company, and that company is responsible for payment. No taxes or port funds are used to retire these bonds, which are subject to strict federal guidelines.

Grants and Gifts

Ports may use a variety of grants or gifts, such as property, to support infrastructure development. In addition, ports may receive federal funding for projects from agencies like the Army Corps of Engineers and the Department of Homeland Security. Washington ports also receive funds from the state, particularly from the Interagency Committee for Outdoor Recreation, the Community Economic Revitalization Board, and the Washington State Department of Transportation.